“The home should be the treasure chest of living.”

Buying a house is not only a significant financial decision but also an emotional one. House is where we create memories, build a life, and call our home. But with this decision comes the difficult task of choosing whether to buy the house with cash or take out a mortgage. The dilemma can leave even the savviest homebuyers scratching their heads.

Owning a house outright and avoiding monthly mortgage payments is enticing. However, it’s essential to consider the trade-offs carefully. Are you willing to tie up a large portion of your liquid assets, possibly missing out on other investment opportunities? Or are you open to taking out a mortgage, with its monthly payments and interest charges, but potentially preserving your liquid assets and benefiting from tax deductions?

In this blog post, we’ll explore the benefits and shortcomings of buying a house with cash versus a mortgage and provide tips on deciding which option is best for you.

Whether you’re a first-time homebuyer or a seasoned real estate investor, this guide will help you navigate the complex decision of how to finance your home purchase. So, buckle up and prepare to make a confident and informed decision about your treasure chest of living.

Table of Contents

Buying a House with Cash

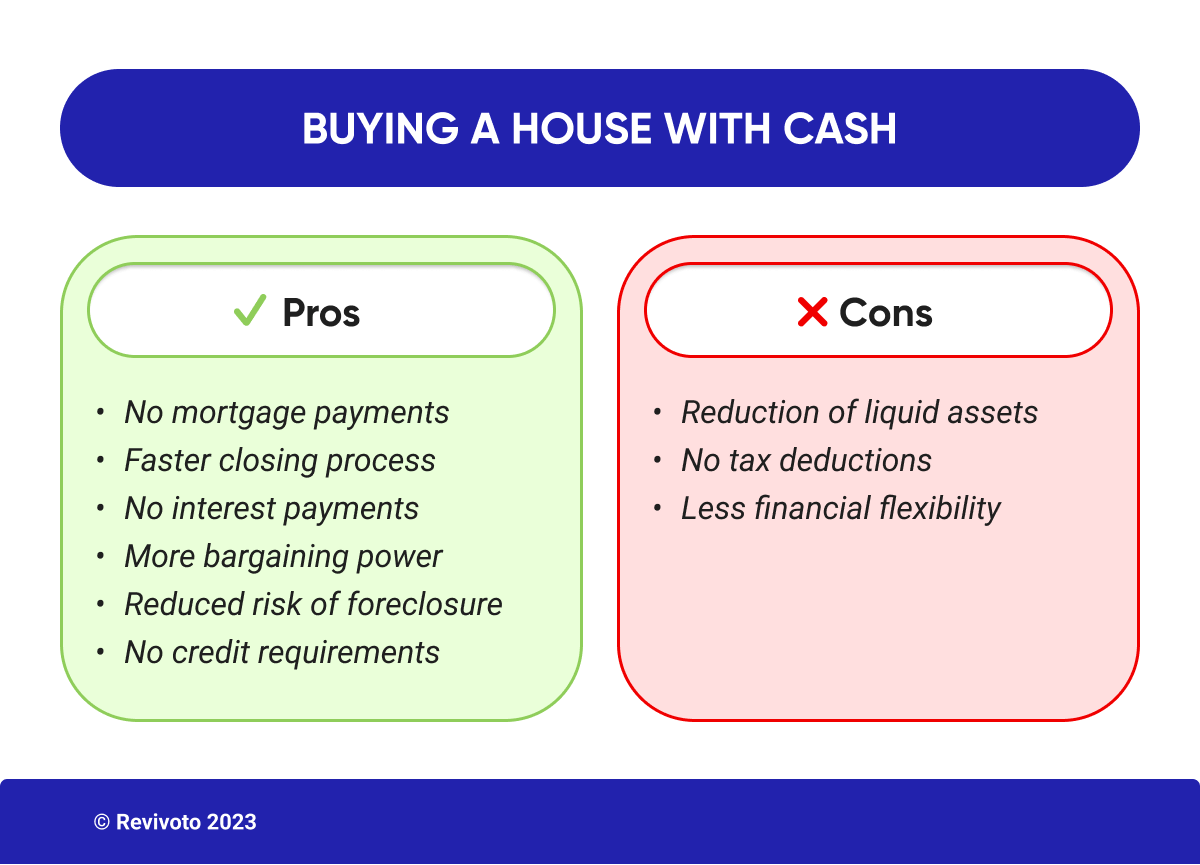

It is a dream for many to buy a house with cash, and it’s not hard to see why. The idea of owning a home outright, with no mortgage payments or interest charges, can be very appealing. However, it’s not a decision to be taken lightly. Buying a house with cash means tying up a significant amount of liquid assets, potentially limiting other investment opportunities. In this section, we’ll explore the advantages and disadvantages of buying a house with cash:

Advantages of buying a house with cash

1. No mortgage payments

When you purchase a house with cash, you eliminate the need for mortgage payments – the monthly amount paid to a lender to repay a loan taken out to purchase a property. The payment consists of both principal and interest. When you buy a house with cash, you avoid these monthly payments and own the property outright.

This way, you can save a significant amount of money over time. Mortgage payments can consume a large portion of your income, leaving less money for other expenses, investments, or savings.

Not worrying about mortgage payments provides greater financial security. Without a mortgage payment, you don’t have to worry about the possibility of foreclosure if you fall behind on payments. In addition, if you were to lose your source of income, you won’t have to worry about making monthly mortgage payments, which can provide peace of mind during times of financial uncertainty.

2. Faster closing process

The closing process can be faster when buying with cash. A cash purchase means you don’t have to wait for a lender to approve your loan application, process the loan, and fund the purchase. That can significantly reduce the time it takes to close on the property.

With a cash purchase, you can close the house in as little as one to two weeks, whereas a mortgage can take several weeks or even months. This faster closing process can be particularly advantageous in competitive real estate markets where properties may receive multiple offers. It can help you stand out as a serious buyer and potentially secure the property faster. Also, a faster closing process can be beneficial if you need to move into the property quickly or have other time-sensitive reasons for buying a property.

3. No interest payments

Mortgage interest is the cost of borrowing money from a lender to purchase a property. It’s calculated as a percentage of the total loan amount and is paid in addition to the principal. You can avoid these interest payments when buying a house with cash.

That can lead to significant cost savings over time. Mortgage interest payments can add up to tens or even hundreds of thousands of dollars over the life of the loan.

Additionally, when you buy a house with cash, you own the property outright, meaning you can avoid the risk of interest rate fluctuations that could impact your mortgage payments. Interest rates can rise or fall over time, and if they rise significantly, it could result in higher monthly mortgage payments.

4. More bargaining power

Cash purchases can give you more bargaining power when negotiating the price. That is because sellers prefer cash offers, as they don’t have to worry about the risk of a mortgage falling through or the time it takes for a lender to approve the loan.

When you have cash on hand, you can make a more attractive offer to the seller by making a higher down payment, offering a quick closing, or even offering to waive contingencies. That can give you an advantage over other buyers using a mortgage and may be subject to more stringent financing contingencies.

5. Reduced risk of foreclosure

One of the advantages of buying a house with cash is that you reduce the risk of foreclosure. Foreclosure occurs when a homeowner defaults on their mortgage payments, and the lender seizes the property and sells it to recoup their losses. When you purchase a property with cash, you do not have to worry about making mortgage payments, and therefore, you eliminate the risk of foreclosure.

However, it’s important to note that foreclosure can still occur in certain situations, such as if the property has liens or unpaid property taxes that need to be resolved. Additionally, unforeseen circumstances such as a job loss or medical emergency could also impact your ability to keep up with property taxes and maintenance costs, potentially leading to foreclosure.

6. No credit requirements

In cash buying, you don’t have to worry about meeting credit requirements or undergoing a credit check, as with a mortgage. That is because you do not rely on a lender to provide the funds to purchase the property. Instead, you are using your cash reserves to buy the property.

That can be particularly advantageous for those with a poor credit history or who have recently experienced financial difficulties. When applying for a mortgage, a lender typically requires a credit score and debt-to-income ratio to ensure you are a low-risk borrower. However, your credit score and financial history are not factors when purchasing a house with cash.

Moreover, buying a house with cash can provide more flexibility regarding the types of properties you can purchase. With a mortgage, a lender may only approve you for a certain amount, limiting the types of properties you can afford. However, when purchasing with cash, you have more freedom to buy properties that may require more repairs or renovations, as you are not subject to the restrictions of a lender.

Disadvantages of buying a house with cash

1. Reduction of liquid assets

One of the most significant disadvantages of buying a house with cash is reduced liquid assets. When you use cash to purchase a house, you are effectively tying up a large number of your available funds in the property. That can be particularly problematic if unexpected financial needs arise. For example, if you encounter a medical emergency or lose your job, you may need access to your cash reserves to cover expenses. If a large portion of your assets is tied up in a property, you may have to sell it or take out a loan against it to access the cash you need.

Reducing your liquid assets may limit your ability to pursue other investment opportunities. If you have excess cash available, you may be able to invest it in stocks, bonds, or other assets that have the potential for high returns. However, if your cash is bound to a property, you may not have the financial flexibility to take advantage of other investment options.

2. No tax deductions

Another downfall of buying a house with cash is the lack of tax deductions for mortgage interest payments. When you finance a home purchase with a mortgage, you are typically eligible to deduct the interest paid on your mortgage from your taxable income. That can result in significant tax savings over time, particularly for high-income earners.

However, when you purchase a home with cash, you do not have any mortgage interest payments to deduct – meaning you miss out on a potentially significant tax deduction that could reduce your overall tax burden.

Furthermore, owning a property outright with no mortgage may increase your tax liability in certain circumstances. For example, if you rent out your property, you will still be required to pay taxes on rental income, but you cannot deduct mortgage interest payments from that income. That could result in a higher tax liability than owning a mortgaged property and deducting mortgage interest payments.

3. Less financial flexibility

When you use all your available cash to purchase a house, you may not have enough funds for unexpected expenses arising during homeownership, such as repairs, renovations, or incidentals.

That can leave you vulnerable to financial strain or even the need to take out loans or lines of credit to cover these costs. It’s important to factor in hidden expenses when deciding whether to use cash to purchase a home or to finance the purchase with a mortgage.

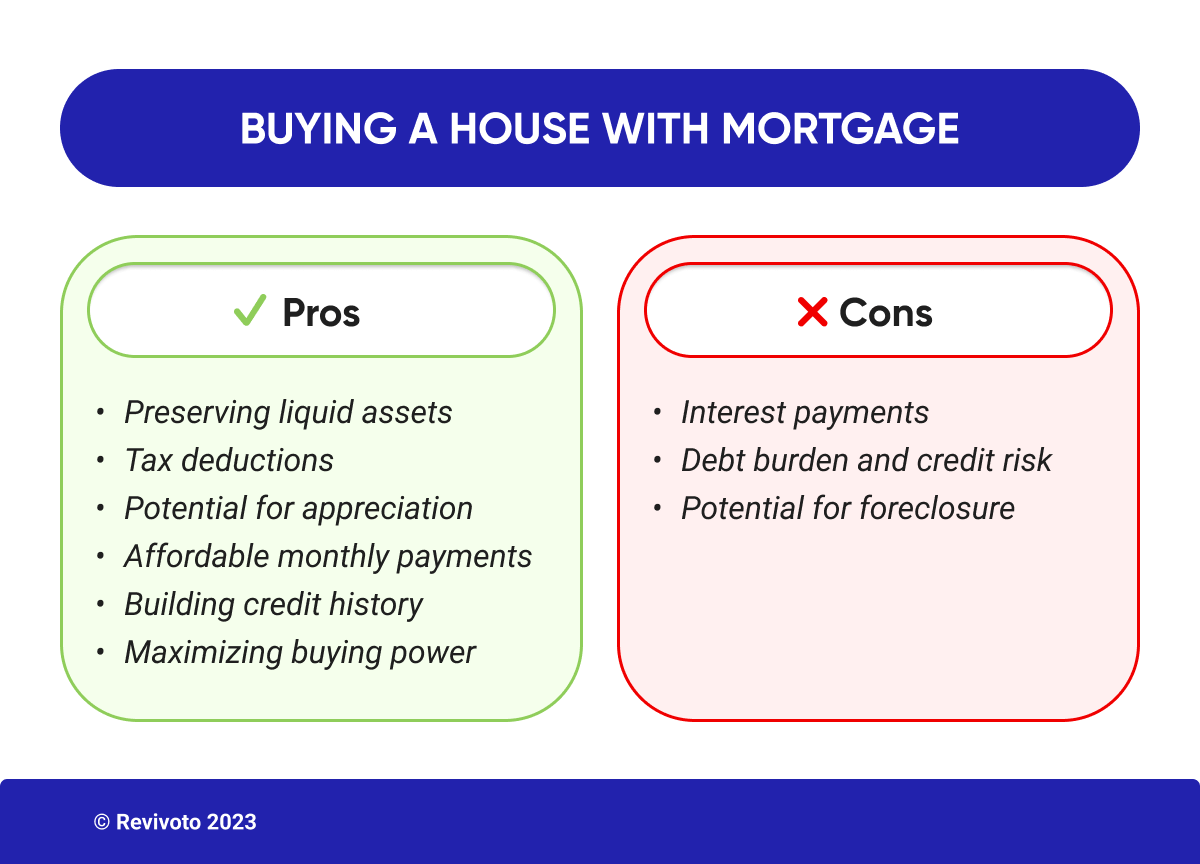

Buying a House with Mortgage

While buying a house with cash may seem like the ultimate dream, it’s not always feasible or even the best option for everyone. Taking out a mortgage can provide flexibility and potentially more significant financial benefits. In this part, we’ll explore the advantages and disadvantages of buying a house with a mortgage:

Advantages of buying a house with a mortgage

1. Preserving liquid assets

One of the advantages of buying a house with a mortgage is that it preserves your liquid assets. When you pay for a house with cash, you put a large chunk of your capital into one asset that may not be easy to sell or convert back into cash. That can be a significant financial risk, especially if something unexpected happens and you need access to your liquid assets.

On the other hand, when you finance a house with a mortgage, you can keep your cash and invest it in other areas such as stocks, mutual funds, or even a business venture. Through that, you can potentially have higher returns, which can help offset the cost of the mortgage interest. In addition, keeping your cash reserves intact can give you a sense of security and financial flexibility in emergencies.

2. Tax deductions

Homeowners who have a mortgage may be able to deduct the interest they pay on their mortgage from their taxable income, which can lower their overall tax burden. That can be especially beneficial for those with a high income and a higher tax bracket. Homeowners may also be able to deduct property taxes paid on their homes.

It’s important to note that the amount of tax savings can vary depending on several factors, such as the size of the mortgage, the interest rate, and the homeowner’s income level. However, even a small tax deduction can add up over time and significantly affect a homeowner’s finances.

It’s also worth mentioning that the tax laws surrounding mortgage deductions can change over time, so homeowners must stay informed about any updates or changes that may affect their deductions. Working with a knowledgeable tax professional can also help maximize potential deductions and ensure compliance with tax laws.

3. Potential for appreciation

Another advantage of buying a house with a mortgage is the potential for appreciation in value over time. As the housing market fluctuates, the value of a property can rise or fall. However, historically, real estate has generally appreciated over the long term. This appreciation can lead to a significant return on investment for the homeowner, especially if they decide to sell the property.

A few key factors can influence the potential for appreciation in a property. Location is often a deciding factor, as homes in desirable areas with good schools, low crime rates, and access to amenities tend to appreciate more quickly than those in less desirable areas. Additionally, the condition of the home, its age, and any renovations or upgrades made to the property can also impact its potential for appreciation.

While there are no guarantees for real estate, investing in a home with the potential for appreciation can be a wise financial decision for those looking to build long-term wealth. It’s important to remember that real estate should be viewed as a long-term investment, and homeowners should be prepared to weather any short-term market fluctuations to reap the benefits of long-term appreciation.

4. Affordable monthly payments

Unlike buying a house with cash, where you have to make a significant upfront payment, with a mortgage, you can make smaller monthly payments over an extended period. That allows you to purchase a house you might not have been able to afford with cash upfront. The monthly payments are typically spread over 15 to 30 years, depending on your mortgage type, making it more affordable for most people.

Another advantage of affordable monthly payments is that they allow you to budget better and plan your finances. With a fixed mortgage rate, you know exactly how much you will pay each month, making it easier to plan and manage your finances. Additionally, affordable monthly payments give you more disposable income to cover other expenses. That can be particularly beneficial if you have children, as you can use the extra money to save for their college education or other future expenses.

Moreover, affordable monthly payments also help you build home equity over time. With each monthly payment, you are paying down the principal on your mortgage, meaning you own more and more of your home. As your equity grows, you may also be able to refinance your mortgage and get a better interest rate or loan terms.

5. Building credit history

One of the key advantages of buying a house with a mortgage is the ability to build a credit history. Your credit history plays a crucial role in determining your creditworthiness, which is essential when securing loans for other significant purchases in the future, such as a car or a business loan. By making timely mortgage payments, you can demonstrate to lenders that you are financially responsible and capable of managing your debt effectively.

A mortgage can help diversify your credit portfolio – another crucial factor in building your credit history. Lenders prefer to see a mix of different types of credit, such as installment loans, revolving credit, and mortgage loans. Having a mortgage in your credit portfolio can show that you can manage sizeable long-term debt and can help increase your credit score over time.

6. Maximizing Buying Power

When you purchase a home with a mortgage, you are leveraging your money to purchase a more expensive property than you could afford with cash. That is possible because you only have to make a down payment on the property and then pay off the rest of the purchase price over time. As a result, you can afford a larger, more expensive home that you cannot purchase with cash.

Maximizing buying power is particularly important in areas with high real estate prices, such as major metropolitan areas or desirable suburban neighborhoods. For many people, buying a home in these areas is not feasible without a mortgage. Using a mortgage, however, increases your buying power. You can purchase a home in a more desirable location that offers a better quality of life, access to better schools or job opportunities, or other amenities.

Disadvantages of buying a house with a mortgage

1. Interest payments

The longer the loan term, the more interest you’ll pay, which can add up to tens or even hundreds of thousands of dollars over a 30-year mortgage. That means while you may be able to afford the monthly payments, you may end up paying much more than the original purchase price of the house due to the interest payments.

The interest rate you receive on your mortgage will also impact how much you end up paying in interest over the life of the loan. Higher interest rates mean higher monthly payments and more interest paid overall. Even a slight difference in interest rates can significantly impact the interest paid. Shopping around and comparing rates from different lenders is essential to ensure you’re getting the best deal possible.

Remember that most of your monthly mortgage payments during the early years of the loan go towards paying interest rather than the principal balance. It means it’ll take longer to build equity in your home, and you may be unable to sell the house for a profit until later in the loan term. Additionally, if you choose to refinance your mortgage, you may reset the clock on your interest payments and pay more in the long run.

2. Debt burden and credit risk

A mortgage is a long-term loan that requires monthly payments for 15 to 30 years, and it can be a significant financial burden for many homeowners. Also, if you cannot make your mortgage payments on time, your credit score will suffer, and you could face foreclosure and lose your home.

Taking on a mortgage also means sacrificing other areas of your life to meet your monthly payments. For example, you may have to cut back on expenses like entertainment or travel or delay critical financial goals like saving for retirement or your children’s education. The stress and anxiety that come with this level of financial commitment can also impact your mental and emotional well-being, affecting not just you but also your family and loved ones.

3. Potential for foreclosure

If you fall behind on your mortgage payments, your lender has the legal right to foreclose on your property, which means you could lose your home. It can be particularly devastating for homeowners, as it means losing their investment and their primary residence. Foreclosure can also have long-lasting effects on your credit score, making it difficult to qualify for loans or credit cards in the future.

Homeowners may be at risk of foreclosure for a few different reasons. One common reason is a job loss or a significant decrease in income, which can make it challenging to keep up with monthly mortgage payments. Additionally, suppose your home’s value decreases significantly, and you owe more on your mortgage than your home is worth (a.k.a. being “underwater”). In that case, you may struggle to sell your home and pay your mortgage.

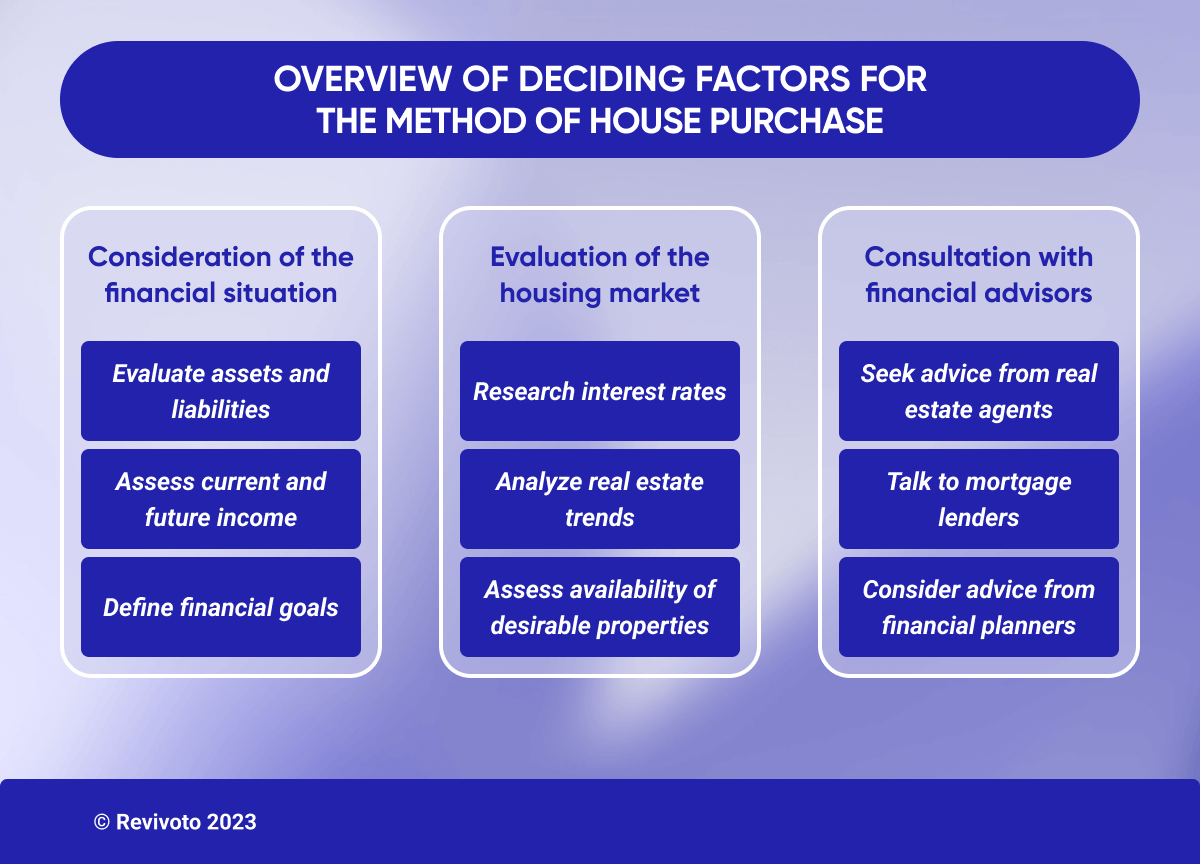

How to Decide between Buying a House with Cash or Mortgage?

Deciding whether to buy a house with cash or take out a mortgage can feel like navigating a maze. Each path has twists and turns; the wrong choice could leave you feeling lost and confused. Both options have pros and cons; ultimately, the decision will depend on your circumstances and priorities.

Here, we’ll explore the factors you should consider when making this decision. From evaluating your financial situation to analyzing the housing market and seeking expert guidance, we’ll help you navigate the road ahead and make an informed choice that best fits your needs.

1. Consideration of the financial situation

- Evaluate assets and liabilities: Before deciding, assess your current financial situation, including your assets (savings, investments, and other properties) and liabilities (debt and ongoing expenses).

- Assess current and future income: Consider your current income and whether it’s stable or expected to increase or decrease. That can help you determine whether you can afford a large cash purchase or if it’s more realistic to spread out the cost over time with a mortgage.

- Define financial goals: Think about your long-term goals, such as saving for retirement or paying off debt. These goals can impact your decision between buying a house with cash or a mortgage.

2. Evaluation of the housing market

- Research interest rates: Interest rates can greatly impact the cost of a mortgage, so it’s important to research current rates and how they may change over time. This way, you can decide if a mortgage is cost-effective for your financial situation.

- Analyze real estate trends: Stay up-to-date on real estate trends in the area you’re interested in. It’ll give you an idea of how prices change and whether it’s the right time to buy a house.

- Assess availability of desirable properties: Determine whether properties are available in your desired area and price range. That can be a deciding factor for your decision between a cash purchase or a mortgage.

3. Consultation with financial advisors

- Seek advice from real estate agents: Real estate agents can help you navigate the housing market and provide insight into the availability of properties, pricing trends, and potential investment opportunities. Therefore, choosing the right real estate agent is crucial.

- Talk to mortgage lenders: Mortgage lenders can help you understand the mortgage process and determine what type of loan may be best for your financial situation.

- Consider advice from financial planners: Financial planners can guide your overall financial plan and how buying a house may impact your long-term goals.

Final Word

We reviewed the pros and cons of different house purchases in this blog. By now, you should have a better understanding of the different factors to consider when deciding between buying a house with cash or a mortgage.

Ultimately, the choice between cash or mortgage will depend on your unique financial situation and personal goals. It’s important to weigh the costs and benefits of each option, evaluate the housing market, and consult with financial advisors before making a final decision.

Whether you’re a cash buyer or a mortgage holder, remember that buying a home is a substantial investment that requires careful consideration. But with the right approach, you can make a sound decision and find your treasure chest of living!

FAQ

There are many speculations regarding the housing market in 2023. If you are relocating to a new city or state and are forced to make a purchase, then the right time is what fits your needs. As for an investment option, here are the facts about the housing market leaving 2022 behind:

- The inventory is tight

- Mortgage rates are high

- If not pressured, sellers are reluctant to sell

- The prices are elevated

All this means you must approach the market intently and monitor all the changes in the region you are willing to invest in.

In general, offering to pay in cash for a house does not necessarily result in a lower offer being accepted. The final decision is up to the seller and their priorities (a quick sale or a higher sale price). However, cash offers can be attractive to sellers as they eliminate the potential complications and delays that can arise with a mortgage. That may give cash buyers some negotiating power, but it varies case by case.