Selling a home can be an emotional rollercoaster ride filled with anticipation, excitement, and sometimes anxiety. Whether you’re a first-time seller or a seasoned pro, navigating the process of selling a home can be overwhelming. The documents you need to sell your house are one of the most critical aspects of this transition. Without the proper paperwork, you could encounter legal issues or even lose out on a potential sale.

In this blog post, we’ll walk you through the essential documents you must have and the ones that are best to have, and the suggested timing for them. So buckle up and get ready to take a deep dive into the world of real estate paperwork!

Table of Contents

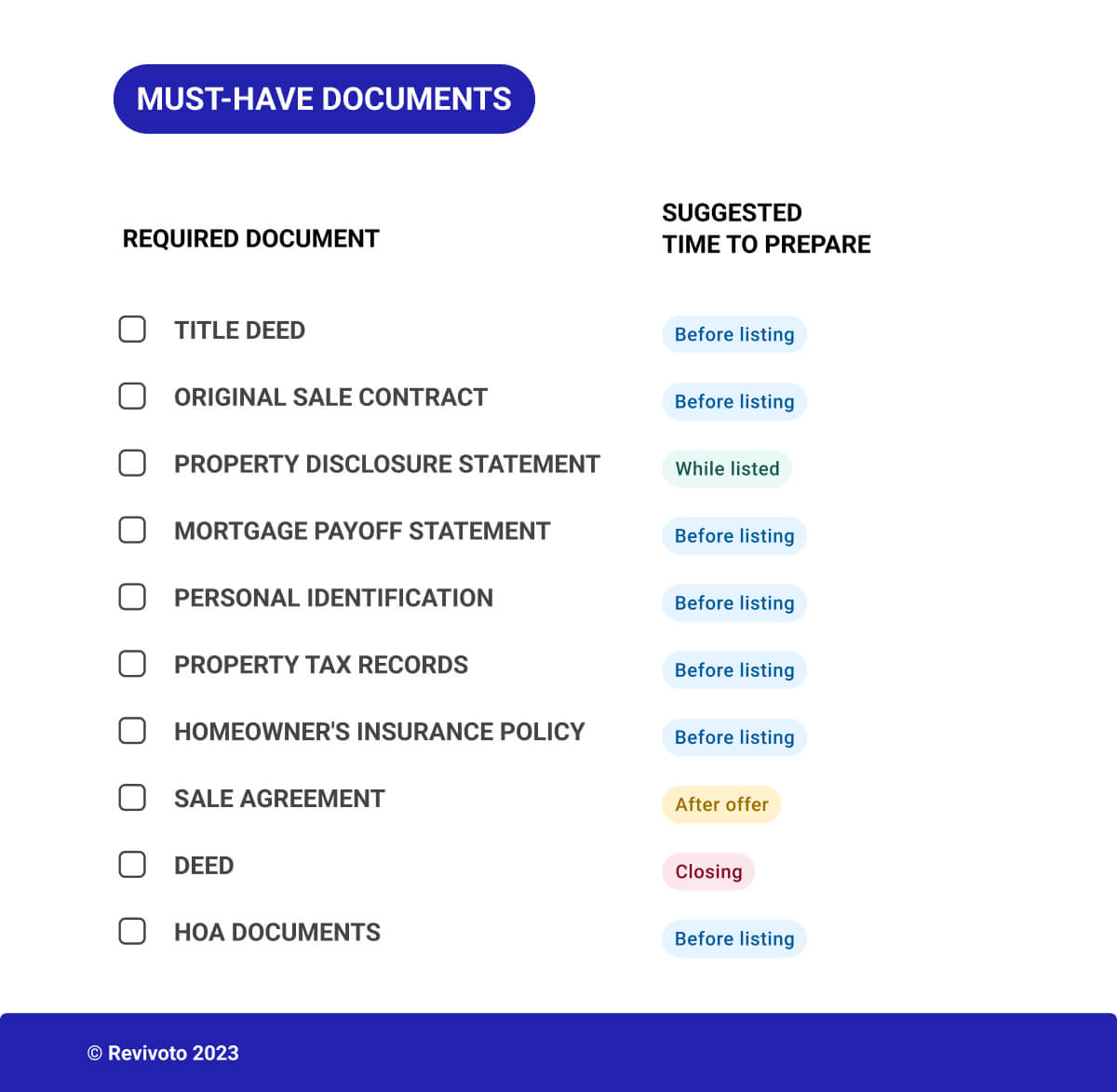

Must-Have Documents for House Sale

Among the documents you need to sell your house, some are obligatory. These are the must-have documents and include the following:

1. Title Deed

It is one of the most important documents for selling a house. This legal document serves as proof of property ownership and assures potential buyers that they are dealing with the rightful owner. The Title Deed includes information about the property, such as its legal description, boundaries, and any restrictions or easements. It is also used to transfer ownership from the seller to the buyer upon the completion of the sale. That is why having an up-to-date and accurate Title Deed is crucial before listing a property for sale.

The Title Deed is typically prepared and issued by a title company or attorney and is recorded with the local county clerk or recorder’s office. This recording is important because it gives public notice of the transfer of ownership and establishes the priority of the property’s ownership. In other words, it ensures that there are no conflicting claims on the property that could affect its value or saleability in the future.

2. Original Sale Contract

This document refers to the legally binding agreement between the seller and the buyer outlining the terms and conditions of the property sale. The contract usually includes important details such as the purchase price, payment terms, closing date, and contingencies. As a required document, the original sale contract is crucial evidence for transferring property ownership. It also ensures that both parties clearly understand their rights and obligations during the sale process.

Providing the original sale contract during the home-selling process helps potential buyers review the terms of the previous sale and better understand the property’s history. It also helps to prevent any disputes that may arise in the future. The original sale contract may sometimes include details on warranties, repairs, or maintenance agreements that the current owner must honor.

3. Property Disclosure Statement

A Property Disclosure Statement (PDS) is a legal document that provides details about any known issues or defects that may affect the value or condition of the property. This document is essential for transparency in the selling process and helps buyers make informed decisions about the property they want to buy. As a seller, it’s important to be honest and upfront about any known issues to avoid potential lawsuits in the future.

The PDS typically includes information about the property’s physical condition, any repairs or upgrades made, and any past or current issues with the property. For example, if the property has a history of water damage or foundation issues, this must be disclosed in the PDS. It’s also common for the PDS to include information about environmental hazards, such as lead paint or asbestos. In some states, the seller is legally required to provide a PDS to potential buyers; in others, it is optional. However, even if it’s not required by law, providing a PDS can help build trust with potential buyers and avoid misunderstanding.

4. Mortgage Payoff Statement

Mortgage documents provide details about the remaining balance on the loan. They show the amount owed, the interest rate, and any additional fees or charges associated with the mortgage.

Having an accurate and up-to-date mortgage payoff statement ensures a smooth ownership transition for the seller. The statement shows the amount owed and details on how to pay off the remaining mortgage balance, allowing the seller to clear the outstanding debt and transfer ownership to the buyer.

For the buyer, the mortgage payoff statement provides essential information for determining the property’s actual value. By knowing the amount owed on the mortgage, the buyer can assess the equity in the property and negotiate a fair price.

5. Personal identification information

It is used to verify the seller’s identity and ensure the sale is legally binding. This information typically includes government-issued identification, such as a driver’s license or passport, and other documents confirming the seller’s identity and residency. The purpose of collecting personal identification information is to prevent fraud and ensure that the seller is legally authorized to sell the property. Without this information, the sale may not be valid and can lead to legal issues down the line.

6. Property Tax Records

These records provide evidence that the property owner has paid all necessary taxes and that the property is in good standing with the local government. When a property is sold, the seller must provide proof of paid property taxes for the current year to ensure that no outstanding tax liabilities could delay the sale. The property tax record also contains information about the property, such as its assessed value, tax rate, and applicable exemptions.

It is essential to keep property tax records up-to-date and organized to avoid any potential delays or disputes during the sale process. The property owner must ensure that they know all their property tax obligations and pay them on time. In some cases, property tax records can also be used as evidence of ownership in the absence of a clear title deed.

7. Homeowner’s Insurance Policy

This insurance typically covers damage caused by fire, theft, natural disasters, and liability for property injuries. The policy will also include details about the coverage limits, deductibles, and any applicable exclusions.

In addition to providing protection for the property, a homeowner’s insurance policy can also impact the selling process. For example, suppose a property is in a high-risk area for natural disasters such as hurricanes or floods. In that case, the insurance cost may be higher, which could affect the overall cost of ownership and impact the property’s value.

8. Sale Agreement

That is a legally binding contract that outlines the terms and conditions of the sale of a property. It is a crucial document in the selling process as it helps to ensure that both the buyer and seller are on the same page and that there are no misunderstandings. The agreement typically includes details about the purchase price, the payment schedule, contingencies, and the closing date. Both parties must review and understand all the agreement terms before signing to avoid potential legal issues.

The Sale Agreement also protects the seller’s interests by ensuring the buyer meets their financial obligations. The agreement may also include contingencies such as a home inspection, appraisal, or financing, which can protect the buyer if any unexpected issues arise during the sale.

9. Deed

That is the final legal document that transfers property ownership from one party to another. The deed includes a legal description of the property, the names of the buyer and seller, and any conditions or restrictions that apply to the property. To be effective, it must be recorded with the county or state where the property is located. Once the deed is recorded, the buyer becomes the official owner of the property.

It is typically prepared by an attorney or a title company and signed at the sale’s closing. The buyer should receive a copy of the deed once it’s recorded.

10. HOA documents

When selling a house that is part of a Homeowners Association (HOA), the seller must provide potential buyers with a set of HOA documents. These documents provide essential information about the HOA’s rules, regulations, and financial status and help buyers decide whether to purchase the property.

One of the key documents in the HOA document package is the CC&R (Covenants, Conditions, and Restrictions). This document outlines the rules and regulations of the HOA, including restrictions on parking, exterior modifications, and noise levels. It also details any fees or fines that may be imposed for violations and the dispute resolution process.

The financial statement is another document in the HOA package. It provides an overview of the HOA’s financial health, including details on how much money is in reserves, any outstanding debts or loans, and the current budget. With this information, buyers can assess the financial stability of the HOA and understand any potential future fees or assessments they may be required to pay.

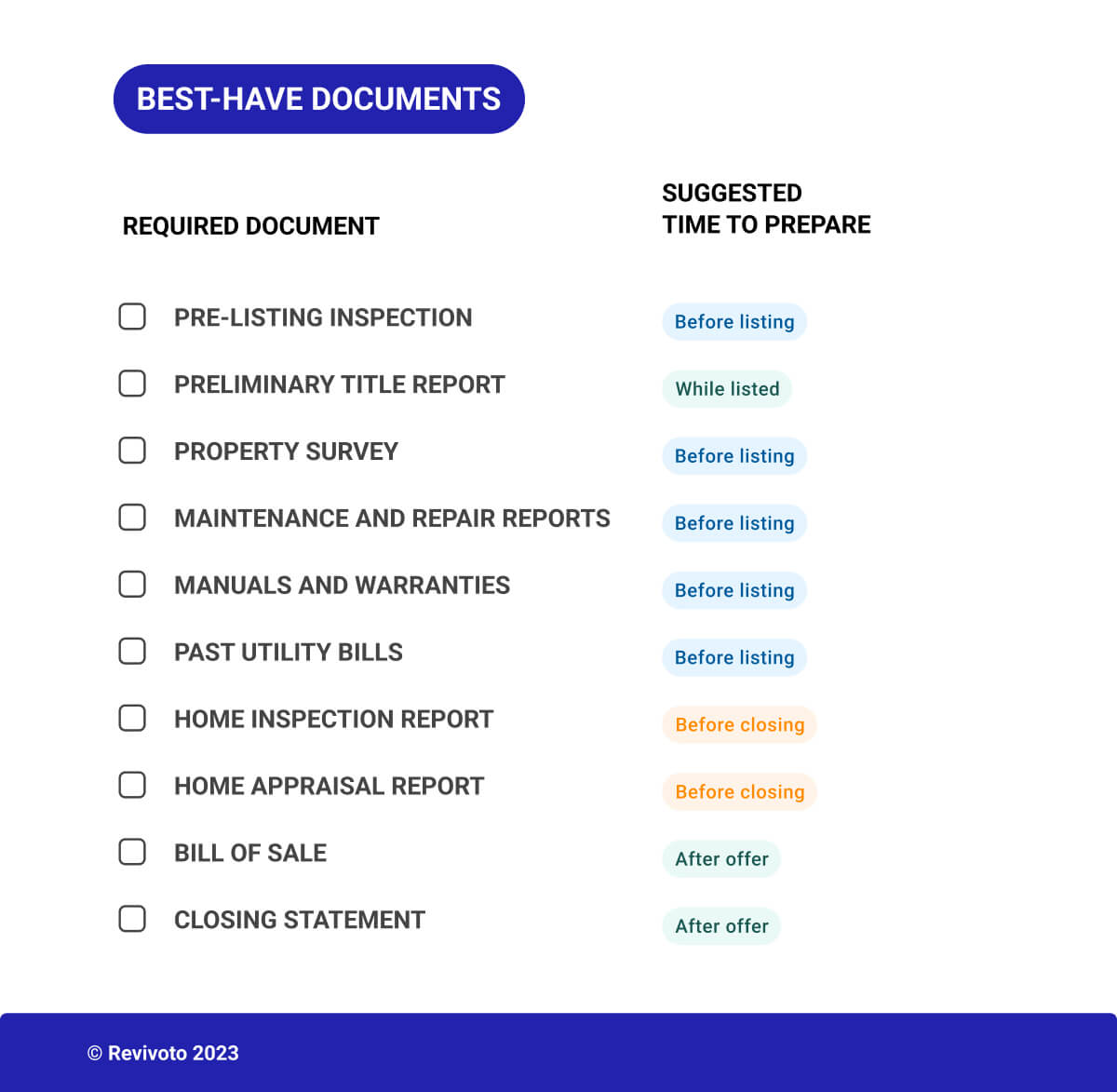

Best-Have Documents for House Sale

The following documents are not mandatory, but they facilitate the transition process and can speed it up.

1. Pre-listing inspection

That provides an examination of a property before listing it for sale. It is typically prepared by a professional inspector hired by the seller, and its purpose is to identify any issues with the property that could potentially impact the sale. By conducting a pre-listing inspection, sellers can address potential problems before listing the property, thereby avoiding potential surprises during the selling process that could delay or even prevent a sale from taking place.

During a pre-listing inspection, the inspector will examine various aspects of the property, including the foundation, roof, plumbing, electrical, HVAC systems, and more. The inspector will provide a detailed report of any issues found and recommendations for repairs or maintenance. By addressing these issues upfront, sellers can potentially increase the value of their property and make it more attractive to potential buyers. Additionally, having a pre-listing inspection report available can give buyers confidence in the property and potentially even speed up the sale process.

2. Preliminary title report

Also known as a prelim, this document provides information about a property’s ownership history and any potential issues that may affect the sale. The seller typically obtains this report before listing the property for sale, as it can help identify any potential problems that may need to be addressed before the deal can go through. The prelim will typically include information about the property’s legal description, current ownership, liens or encumbrances, and easements or restrictions that may affect the property.

One of the most critical aspects of the preliminary title report is its information about any outstanding liens or encumbrances on the property. Liens are legal claims on a property that can be filed by creditors, the government, or other parties. These liens must be paid off before the selling process. Encumbrances, however, are any claims on the property that may affect its value or use, such as easements, covenants, or restrictions. Knowing about these issues ahead of time can help the seller address them before listing the property and help the buyer decide whether to proceed with the purchase.

3. Property Survey

This document outlines the exact boundaries of a property and any structures on it. It can include information about easements, encroachments, and other potential boundary disputes. Having an up-to-date survey before listing a property for sale is best to avoid any potential misunderstandings or legal issues.

An accurate property survey can also provide peace of mind to potential buyers by clearly understanding the property’s boundaries. That can be especially important for properties with irregular or unusual shapes, as it can prevent disputes about the property lines. Buyers can also use the survey to plan any potential improvements or changes to the property, such as adding a fence or building an addition.

Sometimes, the lender or local government may require a property survey before the sale.

4. Maintenance and repair reports

They could be prepared separately or included in PDS or Pre-listing Inspection. These reports can help potential buyers understand the current condition of the home and the quality of any work that has been done. A maintenance and repair report may include details about repairs made to the roof, plumbing or electrical systems, HVAC systems, or other areas of the home. It may also include information about routine maintenance tasks such as cleaning gutters, servicing appliances, and changing air filters.

A maintenance and repair report can reassure potential buyers that the home has been well-maintained and that any issues have been addressed promptly. It can also allow the seller to highlight any recent updates or improvements that may add value to the property. Providing a comprehensive maintenance and repair report can help streamline the selling process and address potential buyers’ concerns.

5. Manuals and Warranties

This information can be helpful to the buyer in understanding how to maintain and operate the home’s systems properly. It can also give the buyer peace of mind knowing that certain systems or appliances are covered under warranty. Standard manuals and warranties that may be included are those for the heating and cooling system, appliances such as the dishwasher or stove, and the roof or other structural components.

In addition to providing peace of mind for the buyer, having manuals and warranties readily available can help prevent any potential delays in the transaction process, as the buyer will not need to request this information from the seller or the manufacturers of the various systems and appliances in the home. Overall, including manuals and warranties as part of the selling process can be a helpful step in ensuring a smooth and successful sale of the house.

6. Past Utility Bills

These bills provide information on the average cost of utilities for the property. The buyer can use these records to determine how much they can expect to pay for utilities and factor it into their monthly expenses. This information benefits first-time buyers who may not be familiar with the average utility costs for a particular area. Additionally, past utility bills can identify potential issues with the property’s energy efficiency, affecting the buyer’s purchase decision.

Furthermore, past utility bills can be a helpful tool for the buyer during negotiations. If the bills are lower than expected, it can be a selling point for the property and potentially increase its value.

7. Home Inspection Report

A home inspection report is a document that provides detailed information about the condition of a property. Typically, a home inspector is hired to conduct a thorough inspection of the property and give a report to the buyer and seller. The report will outline any issues or defects, such as structural damage, plumbing issues, or electrical problems. It may also include recommendations for repairs or maintenance that should be completed.

If significant issues are identified in the report, buyers may be able to negotiate a lower purchase price or request that repairs be completed before the sale is finalized. For sellers, a home inspection report can help identify any issues that must be addressed before the property is listed for sale. Addressing these issues in advance can help to avoid any surprises or delays during the selling process. Additionally, providing potential buyers with a copy of the home inspection report can demonstrate transparency and build trust in the seller.

8. Home Appraisal Report

This report provides a professional assessment of a property’s value. It’s typically required by lenders to determine the maximum amount they can lend to a buyer. A home appraisal report can also help set the listing price for selling a house. By knowing the property’s true value, sellers can avoid overpricing or underpricing their home, which can lead to delays or even failure to sell.

A professional appraiser will consider various factors such as the property’s location, size, condition, age, and recent sales of comparable homes. They will also consider any improvements or renovations made to the property and any current market trends. Once the appraisal report is completed, sellers can use it to justify their listing price.

9. Bill of Sale

It is a legal document used in the process of selling a house to document the transfer of certain items considered personal property, such as appliances, fixtures, or other items not permanently attached to the house’s structure. This document is proof of ownership and transfer of these items from the seller to the buyer. It can help prevent misunderstandings or disputes over what is included in the sale.

It is essential to enlist all the items included in the sale in the Bill of Sale – their condition and any warranties or guarantees. Both the buyer and seller must sign this document, and they should keep a record of it. Sometimes, a separate Bill of Sale may not be necessary if the items are included in the sale agreement or listed in the MLS (Multiple Listing Service) listing. However, it is always a good idea to have a detailed Bill of Sale. That way, you can prevent any potential issues or disputes that could arise during the selling process.

10. Closing Statement

This statement outlines all the fees and expenses related to the sale and is used to calculate the final settlement amount that the buyer needs to pay. It includes the purchase price of the property, any prorated taxes or utilities, real estate agent fees, and other closing costs.

The closing statement typically includes a breakdown of all the fees and expenses associated with the sale, including any loan, title, and escrow fees. It also includes details about payments that have already been made – such as the buyer’s down payment and seller’s closing costs. The escrow agent or closing attorney typically prepares the statement for review before the sale is finalized.

Final word

As we reviewed in this blog, there is a long list of documents you need to sell your house. However, you can easily navigate them once you have a clear picture of what they are, why they are necessary, and when you should provide them. You can download the checklist to ensure nothing is missing and the sale goes smoothly without any bumps in the road.

FAQ

Selling and buying a house without a real estate agent is legal. However, some intricate aspects of real estate transactions require legal knowledge and expertise. You can consult your lawyer for these parts and bring yourself up to date with changes in the market. Also, you can do your research on selling a house without a realtor and go for it yourself.

A short sale may be an option when a homeowner faces financial hardship and realizes they can no longer afford their mortgage. Rather than waiting for the bank to foreclose on the house, the homeowner initiates the short sale process by submitting an application with the lender.

It is challenging to find the right agent and vet them. There are some essential factors that you should take into consideration, including the agents:

- Credentials

- Competence

- Credibility

- Capacity

- Commission

- Compatibility

- Contract