“Knowledge is an unending adventure at the edge of uncertainty.”

It’s hard to accept, but the pandemic brought a solid actor to all aspects of life: uncertainty. The housing market in 2023 is undoubtedly affected by the traces the Covid 19 has left on the economy in general and on the real estate market specifically.

It all started when people stayed home, and remote working became the common trend. That resulted in an unprecedented boom in the real estate market. Due to that, all comparisons and predictions are divided into before and after the pandemic hit.

To foresee where the housing market is headed in 2023, we need to see where we are standing now. So, we’ll start by going through the changes leading to the market status. From there, we’ll review the factors in play, directing where the housing market might be headed in the 365 days to come.

Table of Contents

The Housing Market at the End of 2022

It was a roller coaster of a year, and inflation drastically affected the real estate market. To trace this instability, we can look at house prices and mortgage rates to get a vivid image:

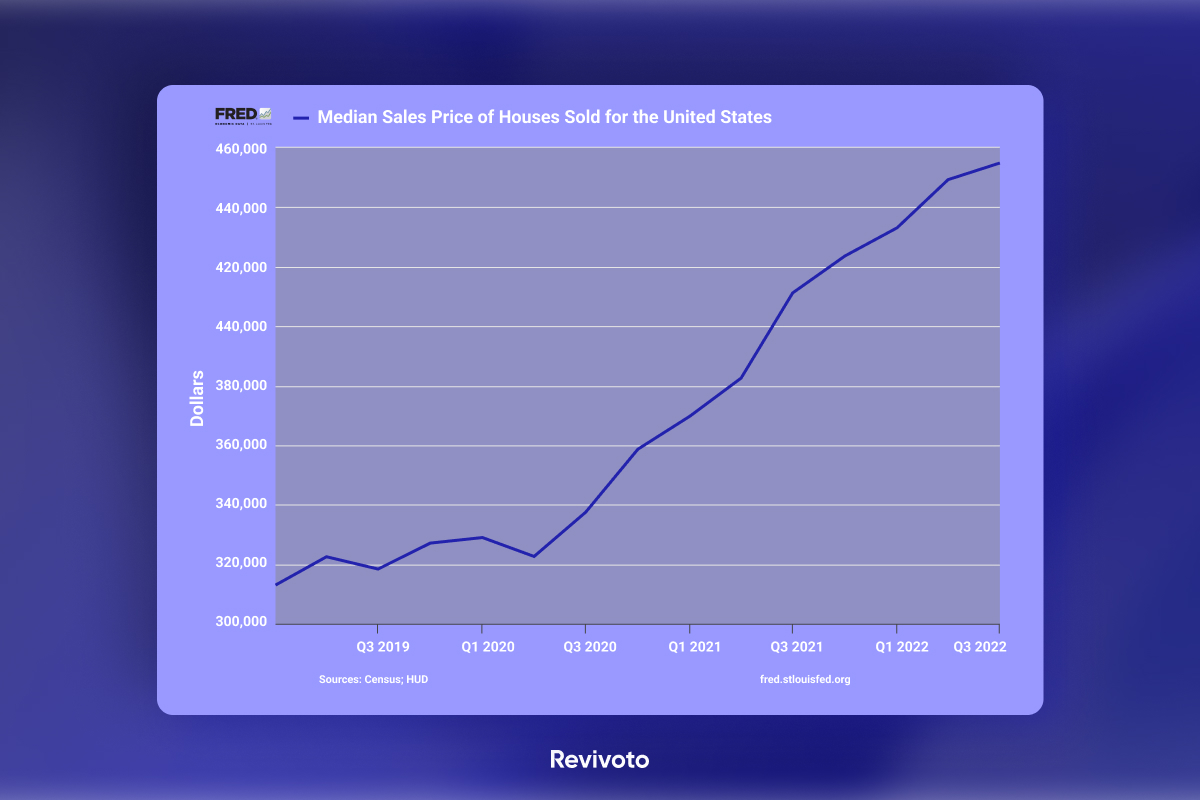

Price growths

Unlike the year before, 2022 did not hold much growth for house prices. With each quarter, we saw a decline in prices, reaching 5% by the end of the year. After the surge post-covid, we are now at a settling stage.

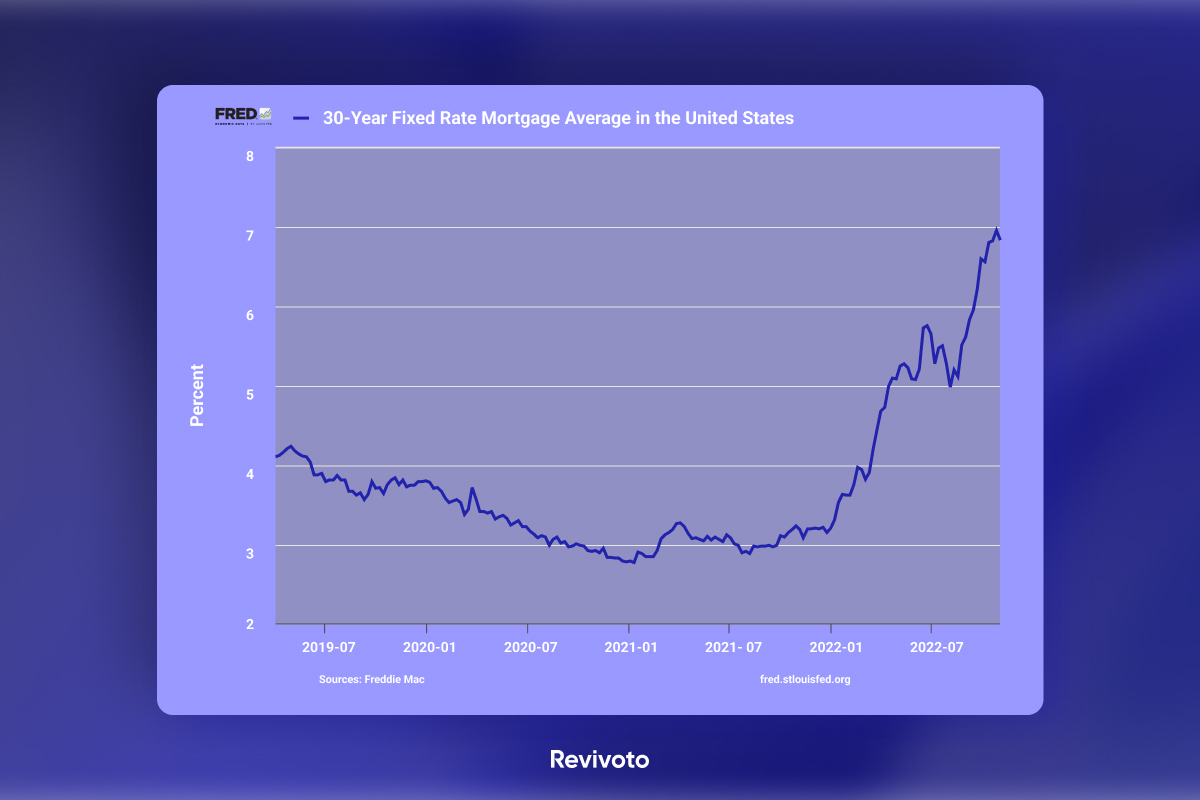

Mortgage rate

The year 2022 witnessed the highest mortgage rates in the past 20 years reaching above 7%. However, there has been a steady decline since November, bringing the rate close to 6%.

According to Freddie Mac, 2022 ended with a 6.42% rate for the 30-year fixed-rate mortgage. Although doubled mortgage rates in 2022 caused a reduction in sales, according to NAR, this year’s 4.7 million home sales are only 4% below the historical average.

What Is Expected From the Housing Market in 2023?

There are different forecasts for the real estate market’s direction, and all these predictions depend on other aspects of the economy. Of course, a lowered mortgage rate would be an incentive for buyers, but only if they are confident of their financial status: would I have job security to pay my mortgage? Is there going to be another recession? And other questions all project the concerns of the players in the real estate market.

From this point forward, we are dealing with various “if”s to predict the circumstances this year. Let’s go through the factors that are significant parties of “if”s.

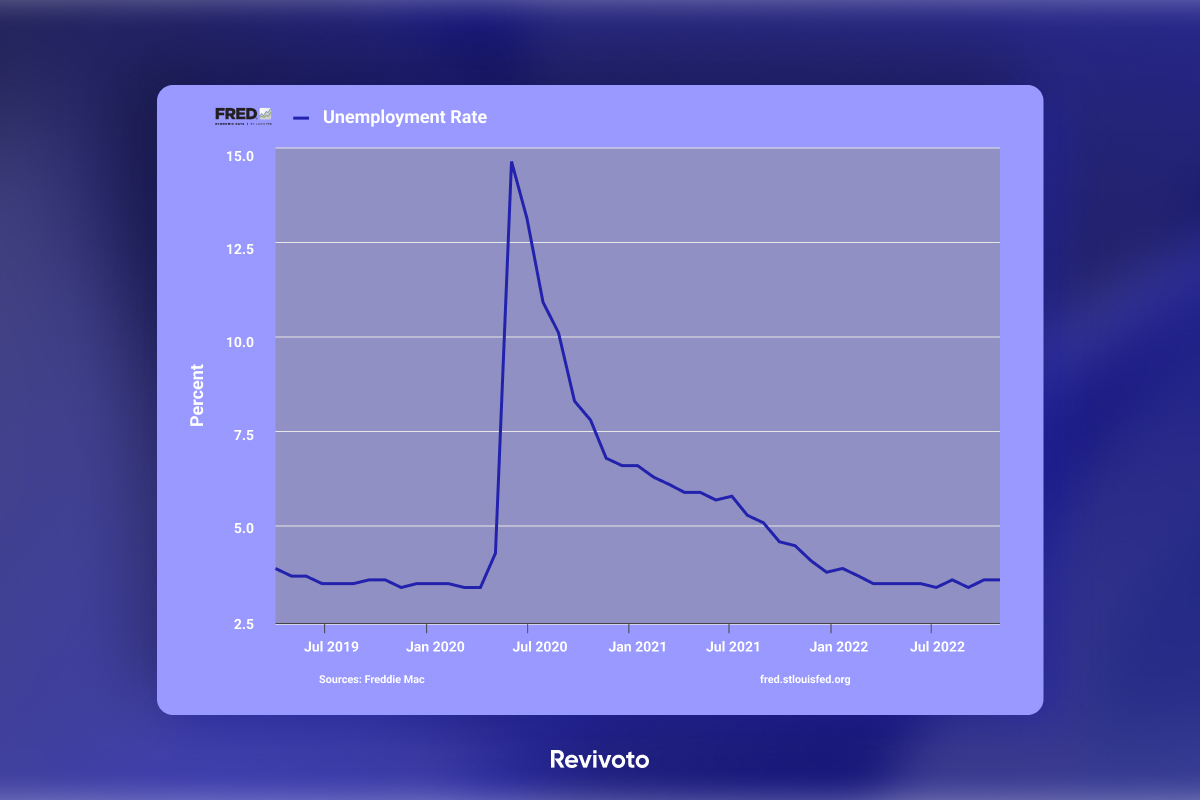

Employment status

The Covid-19 resulted in a steep rise in the unemployment rate. But, now that things are returning to normal, the rate is around pre-pandemic and under 4%. That translates into a rather steady financial status.

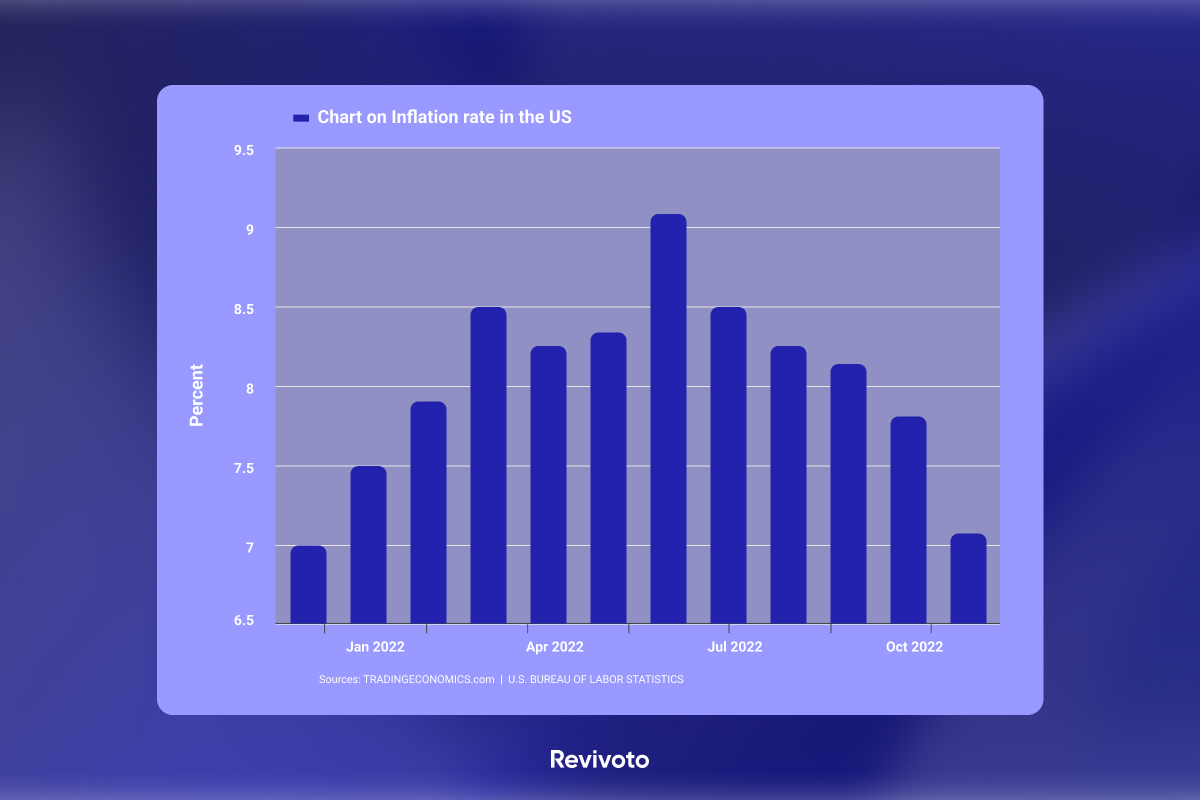

Inflation rate

the inflation’s behavior is another deciding factor. In 2022 it reached a 40-year high which resulted in the rise of mortgage rates. However, inflation seems to be slowing down, reaching 7.1% in November. If this pace continues, we could see its impact on mortgage rates.

Lawrence Yun, the chief economist at NAR, predicts that mortgage rates will settle at 5.7% by the end of 2023.

Inventory

The shortage of new buildings has been an ongoing trend for decades. As Sam Khater, Freddie Mac’s Chief Economist has put it, this deficit goes before the pandemic hit. By the end of 2020, the US was short in house inventory by 3.8 million units.

This decline in new houses, combined with the reduced number of existing homes for sale, results in a limited inventory. Because of that, there won’t be a severe decline in prices.

It is worth mentioning that the shortage in construction has been restricted to single houses. Regarding multifamily homes and apartment buildings, the increased interest will continue since developers prefer to take advantage of the Low-Income Housing Tax Credit (LIHTC) program regarding the construction of affordable housing.

Putting all these data together, the year ahead will feel like sitting down after a marathon. The market will experience a normalcy level, and depending on the changes in the above-mentioned factors, the housing market will hopefully stabilize after the pandemic boom. We could see a rebound in the market in the second half of the year once the dust has settled.

With all the regulations in place post-2008, we won’t be seeing prices dropping drastically in 2023. However, the market will face a drop in prices, but the severity of it will change depending on the region and the economic changes. The areas that saw less action in the post-pandemic will face the least drop in price growth and are considered a more solid investment option.

How Does It Look For First-Time Homebuyers?

It’s already a hard decision to buy a house; Considering the current circumstances, it seems even more challenging. According to Nar , the annual existing home sales were down by 16% closing 2022. So, it’s safe to say the inventory is low in 2023. The upside is that the market has calmed down; you won’t be going through bidding wars. There may be fewer options on the market, but there are fewer buyers as well.

If you are not a cash buyer, the decision to buy your first house also depends on the mortgage rate. If the decline continues, you can go ahead with a 5-6% rate. So, it is best to monitor the changes while assessing other aspects affecting your purchase: your set aside down payment, needs for space and proper location, and overall financial status. This way, you can pick the right time for your first home purchase.

Is 2023 a Good Time for Renters?

With a real estate market holding back on sale, new multifamily houses on the rise, and people returning to their jobs and normal lives before the pandemic, 2023 can be a good year for renting “if…”.

In a slow market, homeowners are leaning towards renting rather than selling. As we discussed, apartment building construction has been steadily rising, which translates into more options on the market. Also, the priced-out buyers who are left out of the market are forced to rent.

On the other hand, if the rent and monthly mortgage payments go side by side, it would make sense for some households to reconsider the buying option.

By the end of 2022, the rental market was cooling down. So, we’ll have to wait and see if this pace continues and stabilizes.

What Are the Prospects for Realtors?

With a slow market, it is possible for many agents to go for a second option, rethink their job, or relocate. However, the buyers’ agent commission might go up, unlike the decline it has gone through in the past years. According to Redfin, the agents who remain in the market through this lull will be able to charge more. The seller side will also participate in the payment since there won’t be any bidding wars like in the prior years.

Conclusion

The housing market in 2023 will be testing Newton’s first law: “every object will remain at rest unless compelled to change its state by the action of an external force.” The challenge is we have multiple forces at play right now, and they can neutralize or overpower each other.

Being cautiously optimistic, we can say 2023 is going to be more correcting than crashing regarding the aftermath of the pandemic. Through all this, any action in the market requires adequate data, not just about the market but also about your status. This way, you will overcome uncertainty, whether it likes it or not.

FAQ

If you are relocating to a new city or state and are forced to make a purchase, then the right time is what fits your needs. As for an investment option, here are the facts about the housing market leaving 2022 behind:

- The inventory is tight,

- Mortgage rates are high,

- If not pressured, sellers are reluctant to sell,

- The prices are elevated.

All this means you must approach the market intently and monitor all the changes in the region you are willing to invest in.

The final quarter of 2022 witnessed a firm decline in mortgage rates, ending the year at 6.42%. However, real estate market experts only estimate a rate above 5% in the second half of 2023.