NFTs, crypto, blockchain, the metaverse, digital assets, Ethereum, tokens, fungible vs. non-fungible, etc.

If you’ve been living on Earth for the past few years, you’ve most certainly heard some of these words from an eager cousin who wants to see the whole family rich or that all-knowing coworker who’s going to be the next Elon Musk.

Well, the truth is we’re living in a digital world, and all aspects of human lives and societies now have a digital side. Real estate is no exception, and on the path of digitization, the world of real estate is now also being virtually run based on different concepts, one of which is non-fungible tokens or NFTs.

In this article, we’ll briefly introduce NFTs, discuss the role and benefits of NFTs in real estate, the various types of NFTs in this industry, and help you learn how to create NFT real estate.

Table of Contents

Non-Fungible What?

Non-fungible tokens, or NFTs, are unique digital assets representing ownership or proof of authenticity for a specific item or piece of content. They can represent almost anything, from music tracks to artwork to even a piece of writing.

What does it mean when a token is non-fungible? According to OpenSea, one of the world’s largest NFT marketplaces, “When an item is fungible, it means it’s interchangeable with another of the same item. A classic example is a $1 dollar bill: you could swap dollars with someone and you’d both still have $1.”

However, when an item is non-fungible, it means that it is absolutely unique based on a set of parameters and therefore has its own value in real or digital currency.

Unlike other digital assets like cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs have distinct properties that make them unique. Even two NFTs identical in appearance can have different unique values. Take two similar cars, for example. They can have different values depending on parameters such as mileage, accident record, previous owner, year of production, etc.

What Makes NFTs Unique?

Uniqueness

Well, to begin with, NFTs are inherently unique, as mentioned above. Each NFT has a distinct digital signature that sets it apart from other tokens, making it a one-of-a-kind asset.

Ownership and authenticity

NFTs utilize blockchain technology to establish verifiable ownership and provide proof of authenticity for digital or physical assets they represent.

Scarcity

Some non-fungible tokens can be limited in quantity, creating scarcity and exclusivity for collectors and investors, increasing their price value.

Interoperability

NFTs can be bought, sold, and traded on various platforms and marketplaces, enhancing their liquidity and market accessibility.

Programmability

A notable customizable feature of NFTs is their programmability. NFTs can be equipped with smart contracts, allowing creators to define specific rules and conditions for their ownership, such as royalty distributions or usage rights.

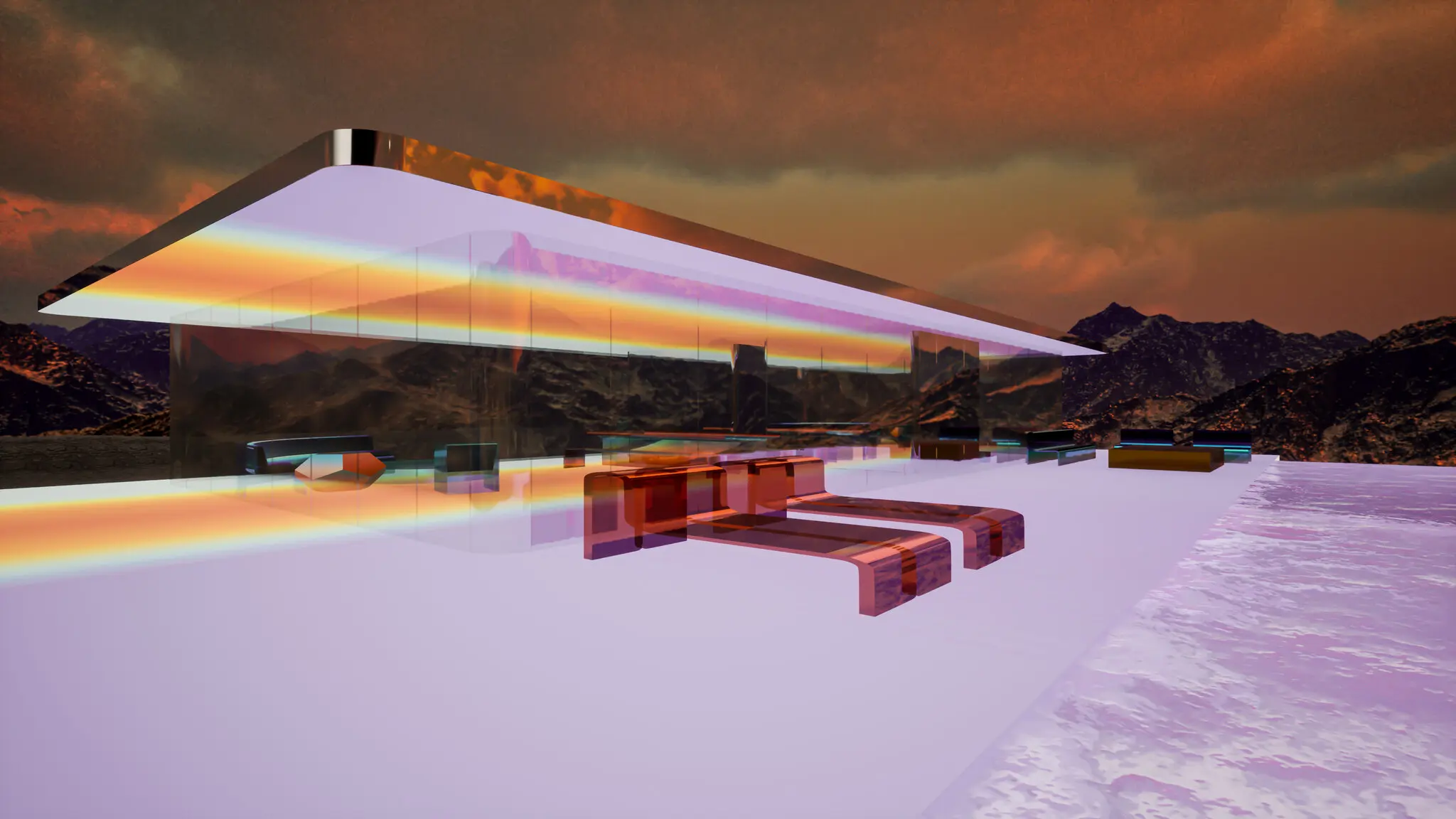

Mars House was designed to be visited and enjoyed in the metaverse, a shared virtual space.Credit…Krista Kim

What’s It Got to Do With Real Estate?

Shortcomings of traditional real estate

Real estate, by tradition, is one of those super bureaucratic industries involving multiple intermediaries, extensive paperwork, and lengthy legal procedures. In today’s fast-paced world, where competition is fierce in any industry, several limitations come to mind when thinking about the traditional real estate market.

illiquidity

Traditional real estate assets are often illiquid, meaning they are not easily converted into cash. Buying or selling a property can be time-consuming, involving in-person visits, negotiations, paperwork, inspections, legal procedures, etc.

entry barrier

Typically, the real estate market requires significant capital to purchase properties, making it inaccessible for many. As for fractional ownership, which is easily possible in the world of NFTs, traditional real estate marketplaces do not often provide convenient options, which restricts investment opportunities.

limited market access

Market access in traditional real estate is often limited to local or regional areas, restricting the potential buyer and seller pool. Property purchases in other countries or even states/provinces can be legally complex, lengthy, and resource-intensive.

high transaction costs

Traditional real estate transactions involve various costs, including agent fees, legal fees, title searches, and taxes, significantly impacting the overall transaction cost.

lack of interoperability

The mainly centralized system of the traditional real estate market means all interactions and transactions are limited to a standardized, often heavily regulated platform, limiting interoperability and hindering the seamless transfer of ownership.

lengthy legal processes

Transactions in the traditional real estate market involve extensive legal procedures, such as title searches, documentation, contract negotiations, etc., which can lead to delays and additional costs.

NFTs have transformed the industry

Naturally, the fast-paced, highly disruptive digital world was bound to enter this industry and make fundamental changes. Contrary to conventional real estate interactions, utilizing NFTs in the real estate industry introduces several distinct advantages.

accessibility and global reach

NFTs enable individuals worldwide to participate in real estate transactions without geographical limitations, promoting a more inclusive and global marketplace. As digital assets, NFTs transcend geographical boundaries and enable global participation, expanding market access and increasing market efficiency.

fractional ownership and liquidity

NFTs allow for easy fractional ownership, dividing properties into smaller units and making real estate investments more accessible to a broader range of investors. Moreover, through fractional ownership, NFTs provide increased liquidity by enabling the easier selling of fractions or entire properties and facilitating trading on digital marketplaces.

transparency and security

NFTs leverage blockchain technology to provide transparent and immutable records of ownership, transaction history, and property details. This transparency enhances trust, reduces fraud risks, and eliminates the need for intermediaries to verify property ownership.

automation and efficiency

Smart contracts associated with NFTs automate and enforce predefined rules, streamlining processes and reducing the dependency on intermediaries. This automation minimizes paperwork, speeds up transactions, and reduces associated costs.

Also, built on blockchain technology, NFTs are interoperable and can be easily transferred and traded on various platforms and marketplaces, enhancing market accessibility and efficiency.

enhanced ROI

NFTs introduce new revenue streams and investment opportunities by allowing property owners to sell fractional shares, generate income from royalties, or monetize digital assets associated with real estate.

digital representation and portability

NFTs represent digital ownership of real estate assets, enabling more efficient transfer of ownership and easier verification. This digital representation also allows for greater portability and interoperability across different platforms and ecosystems.

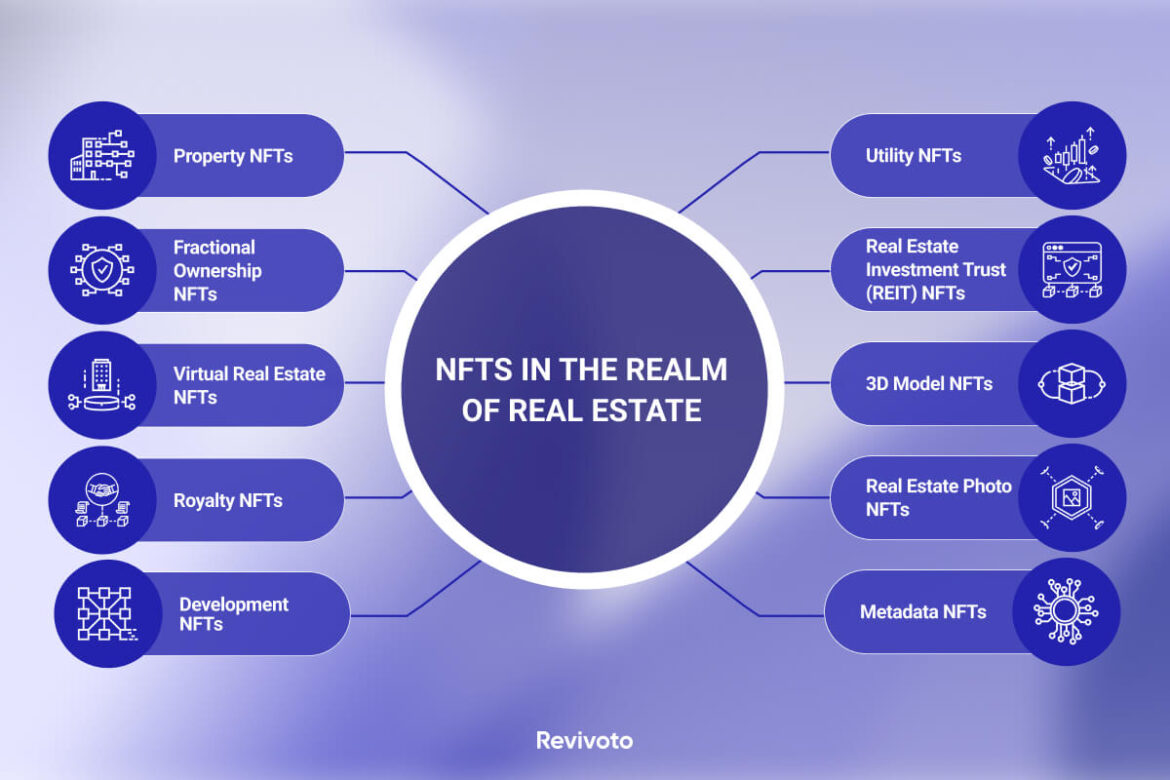

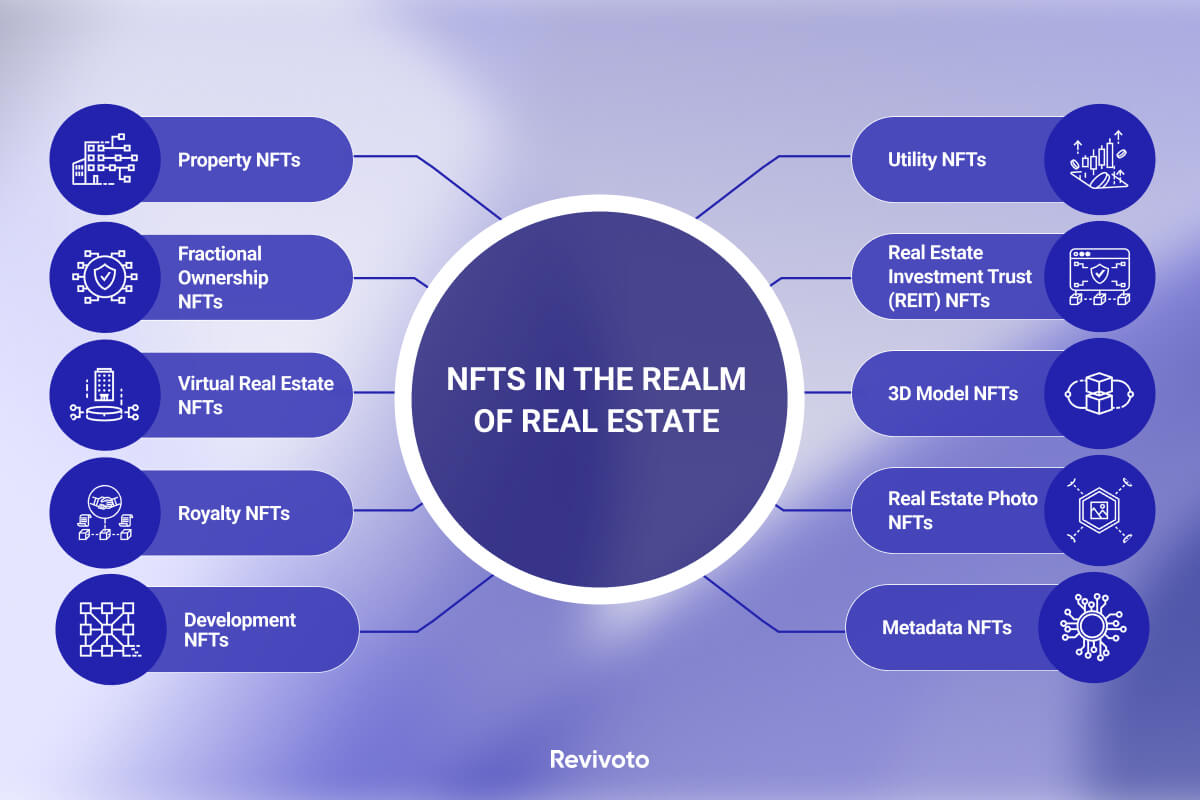

What Kind of NFTs Exist in Real Estate?

Property NFTs

NFTs can represent individual properties or real estate assets. Each property token is unique and serves as a digital representation of ownership or proof of authenticity. These tokens can be bought, sold, or traded on blockchain platforms, allowing for efficient and secure transfer of ownership. One cannot help thinking the days of traditional real estate ownership are numbered…

Fractional ownership NFTs

Fractions or shares of properties can also be tokenized via NFTs, enabling partial ownership. Each fractional ownership token represents a portion of the property, allowing multiple investors to claim ownership of a single property. These tokens can be traded among investors, providing liquidity and flexibility in real estate.

Virtual real estate NFTs

Ever heard of a metaverse? Though first coined in 1992, this term received much hype around 2019 when Meta boss Mark Zuckerberg announced his company’s commitment to creating virtual worlds. In the realm of metaverses, NFTs can represent ownership of virtual real estate. These tokens are associated with specific virtual properties, such as virtual land, buildings, or other digital assets within the virtual environment.

Royalty NFTs

Ownership of royalties or income generated from a property or real estate asset is also possible through NFTs. These tokens entitle the owner to a portion of the revenue generated by the property, such as rental income or revenue from the use of associated digital assets.

Development NFTs

NFTs can be used to represent ownership or access rights to development opportunities within a real estate project. These tokens may allow the owner to participate in decision-making processes, vote on development plans, or access certain privileges within the project.

Utility NFTs

Utility tokens within real estate ecosystems grant owners certain rights or access to specific services, amenities, or benefits associated with a property or real estate project. For example, owning a utility token may provide access to exclusive facilities or services within a condominium complex. These kinds of tokens have been quite popular with sports clubs, giving fans certain privileges to access some of the clubs’ facilities and events.

Real estate investment trust (REIT) NFTs

NFTs can be used to create digital representations of real estate investment trusts. REITs are investment vehicles that pool funds from multiple investors to invest in a portfolio of income-generating properties. NFTs represent REIT shares, allowing investors to trade and exchange these shares on blockchain platforms.

3D Model NFTs

3D models of structures, buildings, or even items and furniture can also become NFTs. If you’re a designer or modeler, you can create 3D models of various structures or objects and turn the final results into virtual tokens, which can be sold or exchanged online.

Real estate photo NFTs

Any photo can become an NFT. Therefore, in the world of real estate, you can turn any snapshot of any building into an NFT. Also, you can turn architectural designs, blueprints, etc. into NFTs as well. Some consider content like blueprints as metadata NFTs that don’t have much monetary value but are priceless and need to be kept safe on the blockchain.

A more entertaining idea for virtual tokens is NFT cards. Imagine a stack of trading cards similar to what you have for sports, but instead of the pictures of athletes, you use photos of famous buildings and landmarks or real estate photos from property listings.

Metadata NFTs

These virtual tokens represent the metadata associated with a property, such as property details, transaction history, legal documents, architectural plans, or certifications. These tokens are a secure and transparent way to store and manage important property-related information on the blockchain.

Mars House, a digital house designed by the artist Krista Kim, sold for an amount equal to $512,000.Credit…Krista Kim

How to Create NFT Real Estate? It’s Seriously Not Rocket Science!

To learn how to create NFT real estate, you can go down in either of two directions:

- Purchase a real estate NFT

- Create your own real estate NFT

Now let’s see how you can start adding an NFT to your real estate portfolio.

- First things first, figure out what you want. The answer to this question is very important since different types of NFTs have different marketplaces and audiences.

- Whether you’re creating or buying, you’ll first need a digital wallet. There are many out there, but wallets like Metamask, Trust Wallet, and Coinomi are quite well-known.

- Once you have downloaded and created your digital wallet, you should start your research for a suitable marketplace. Marketplaces are online websites where you can auction off your NFTs. Examples of famous and dependable marketplaces are OpenSea, Mintable, and Mintbase.

- At this stage, you need to buy cryptocurrency. Buying Ethereum is always a safe choice since most marketplaces accept ETH, but doing a little research on your marketplace of choice is a good idea. Find out which cryptocurrencies or native tokens they accept and buy the amount you need using your digital wallet.

Here’s the fun part!

- If you’re only looking to buy available NFTs, simply start browsing the marketplace like you would near Christmas for a steal. Sometimes, you have to bid. Other times, you can simply pay a fixed price and own an NFT.

- If you’re feeling creative or have a brilliant idea, however, you should get busy with the design process. For NFT creation, the sky’s the limit! If you’re a professional designer, you know what to do. From photos to posters to intricate 3D models, you can make anything come to life and turn it into an NFT. But if you don’t have much graphic design experience, there are many simple ways to create real estate NFTs. You can use services like Canva to create a number of listings or simply shoot photos of property listings, landmarks, etc. and use those photos for the creation of NFTs.

- Once you have finalized your material, either open your digital wallet or go to the marketplace of your choice. Most wallets and marketplaces usually have detailed instructions on how to upload and create – or mint – an NFT.

- Congrats, you now have an NFT! But we’re not done yet! The NFT market is based on supply and demand, so if you’re looking to add value to your NFTs, you need to create an auction or sale so others can see your NFTs and their price.

- And finally, just like any other commodity or item, you need to start marketing your NFT listings if you wish to make a sale and some profit. Remember, NFTs don’t sell themselves.

Not Quite Sure? Here are Four Real Life Examples

Entering the NFT world can be daunting, and you should exercise caution with virtual investments. However, you don’t have to start big, like creating your own metaverse. There are currently a number of proven virtual worlds where you can comfortably create, buy or sell real estate NFTs.

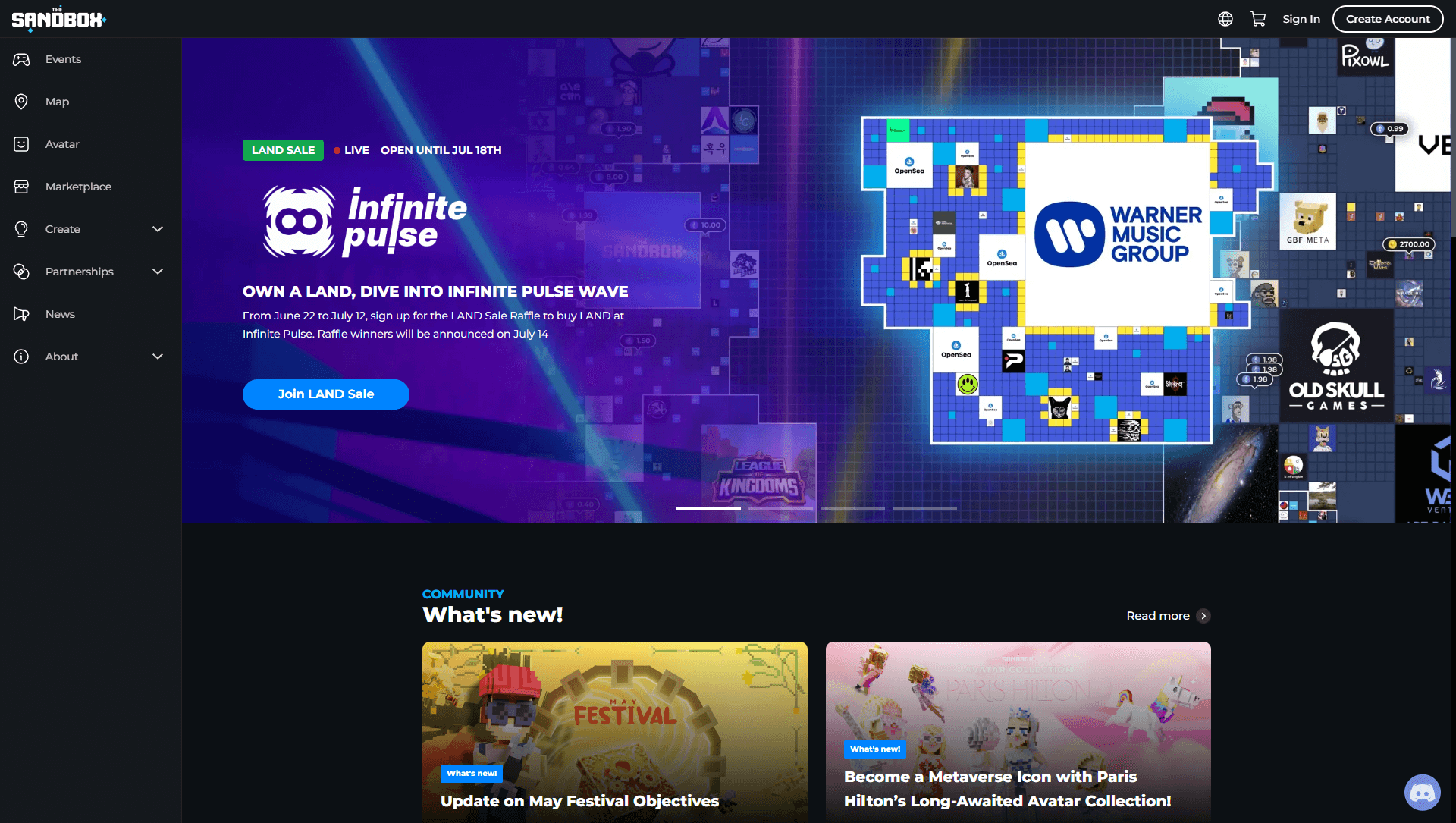

Sandbox

Sandbox is a real estate NFT gaming platform where users can monetize their in-game experience.

Sandbox has steadily grown over the years and attracted a large user base. Their native virtual token, SAND, is used as currency to make virtual transactions.

With 3 million users, over 5 million distributed SANDs, and more than 15,000 NFTs sold, Sandbox has become one of the largest NFT virtual worlds.

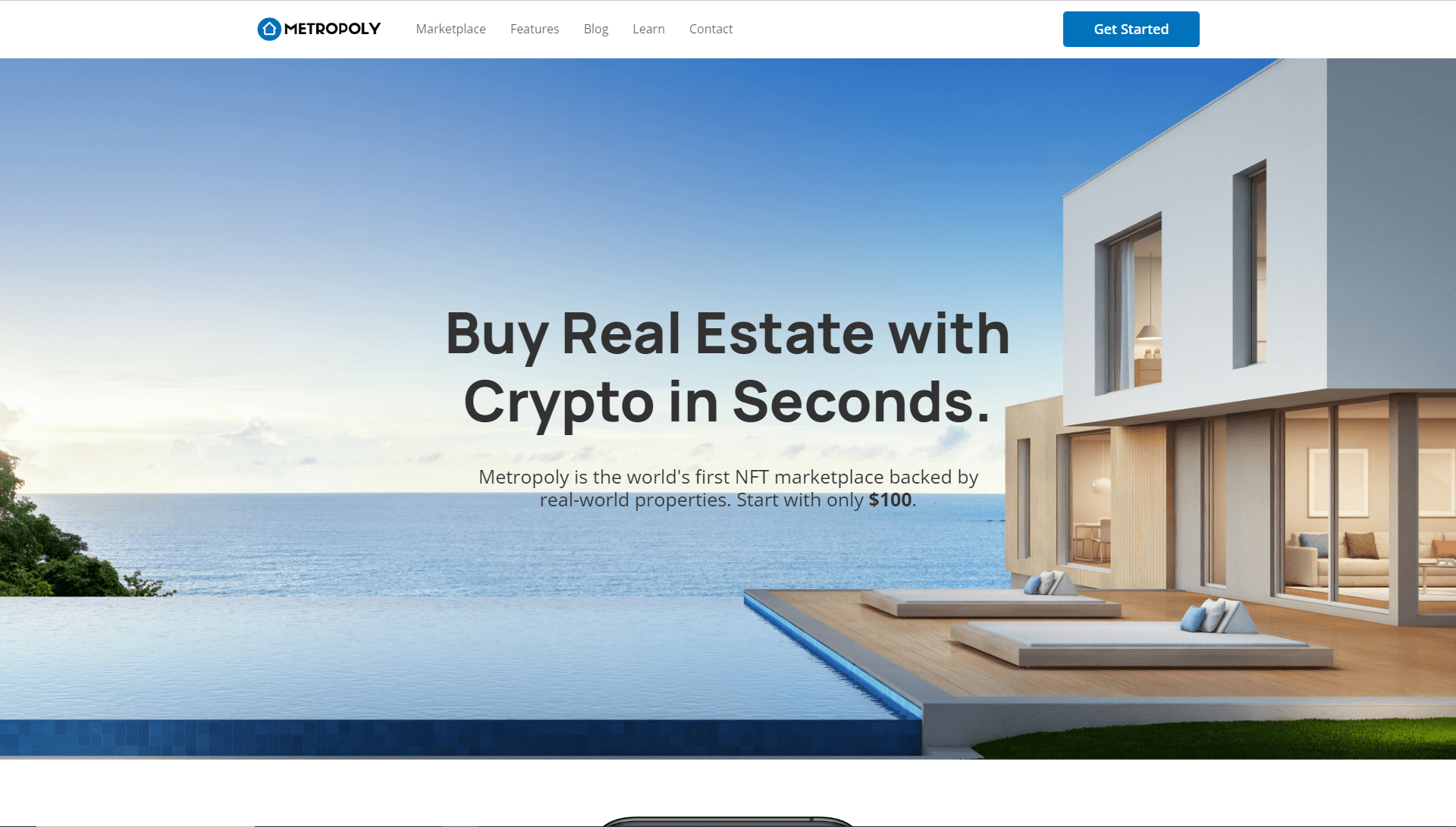

Metropoly

Metropoly is a well-known real estate platform in the NFT world. It allows users to access, buy, sell, and trade real estate NFTs and provides most of the advantages mentioned above, such as liquidity, global access, fractional ownership, etc.

Buying real estate tokens on Metorpoly gives users the chance to create a colorful portfolio of shares and possessions and earn passive income from their virtual properties.

Metropoly has shown notable promise. In the first quarter of 2023, METRO, Metropoly’s token, surpassed its initial goal of $750,000 by raising over $944,000.

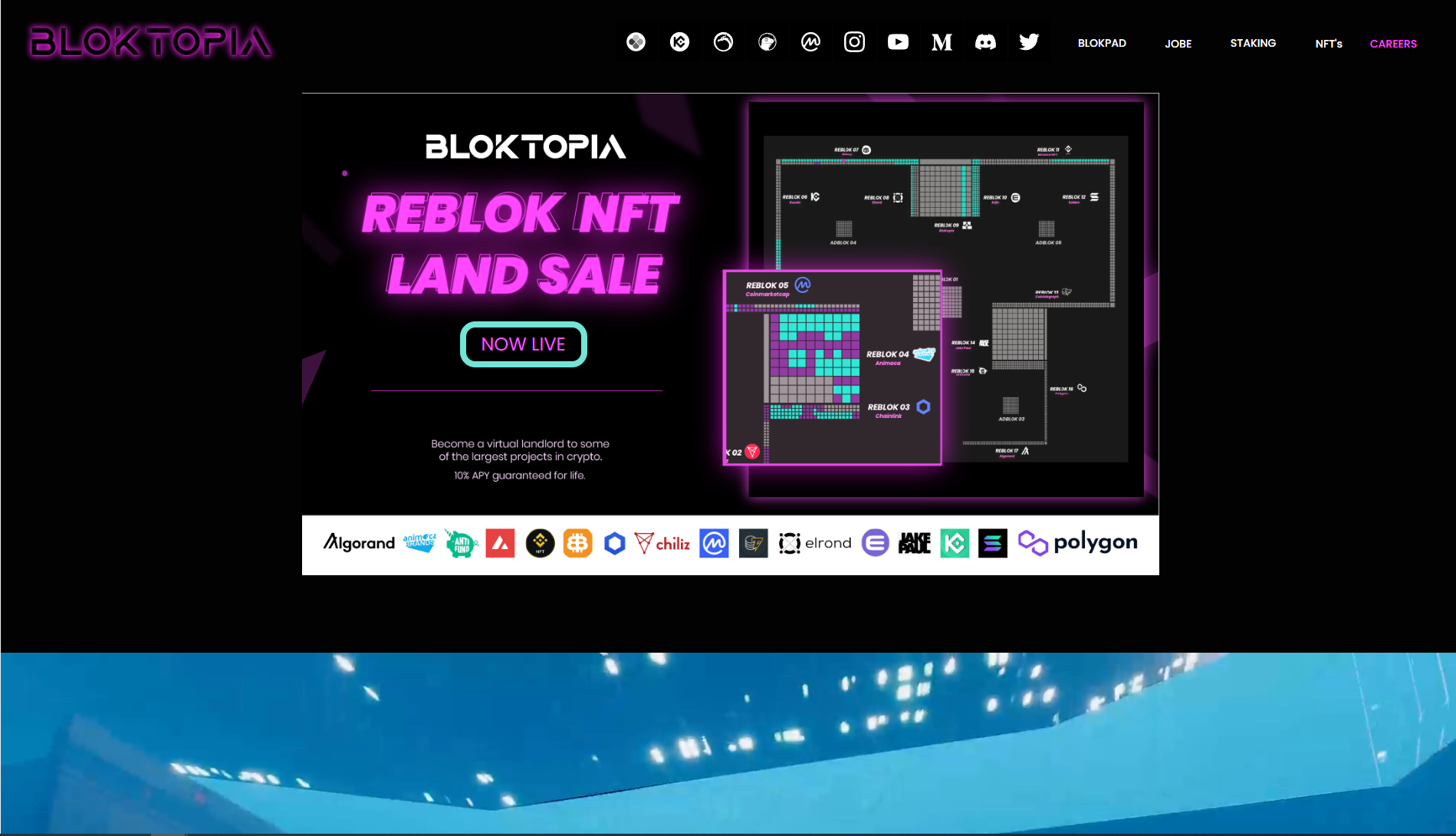

Bloktopia

Talk about a sense of belonging! Bloktopia is a Web3 virtual real estate project and holders of Bloktopia tokens are referred to as Bloktopians!

Using BLOKs, the project’s own tokens, users will be able to interact, buy, sell, trade and so on. Just like actual real estate and similar to other virtual worlds, you can use your properties for a number of side activities and projects or rent them out to other users.

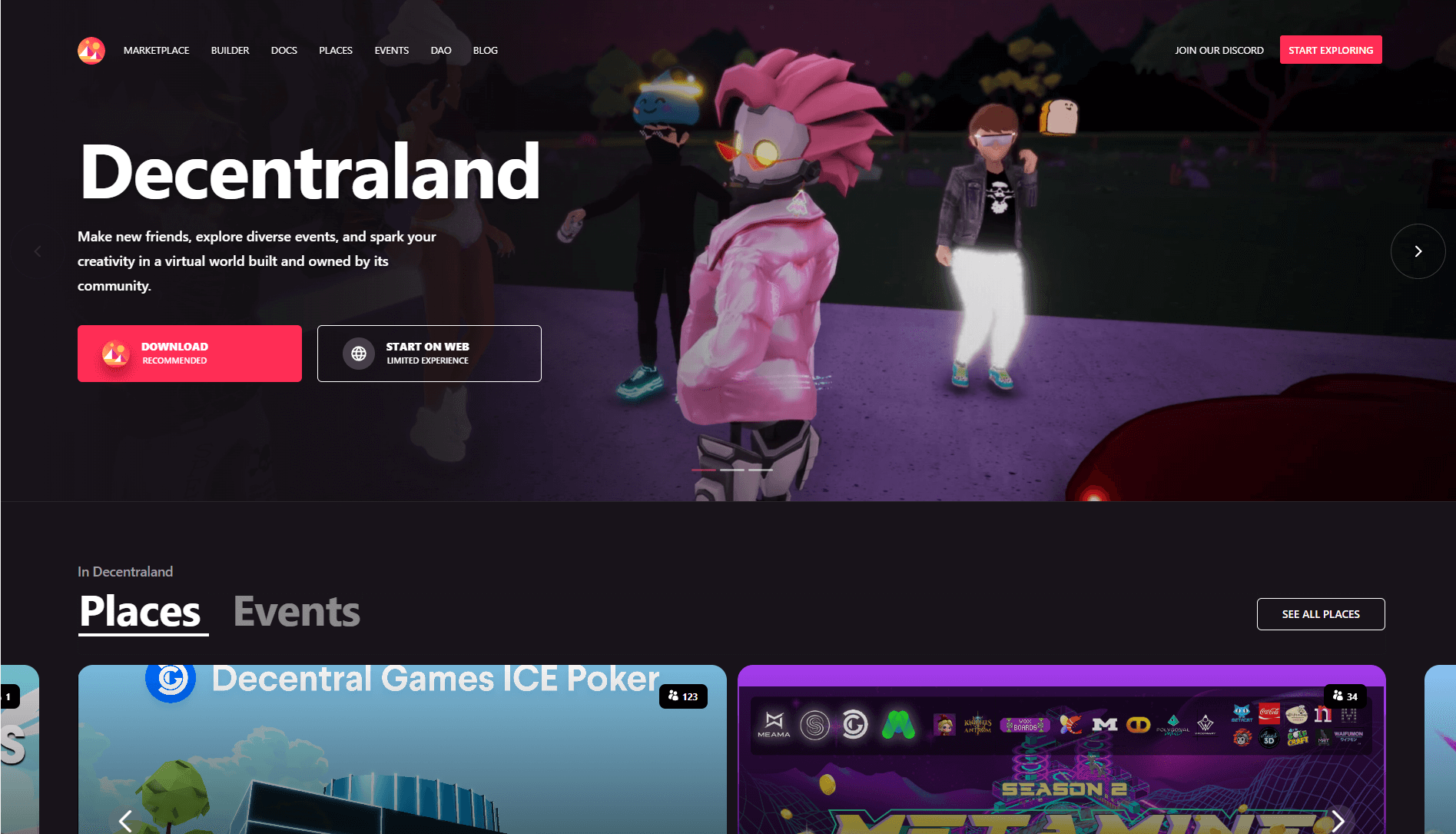

Decentraland

Established in 2015, Decentraland is a virtual that is based on building and owning NFT virtual spaces called “lands” and “parcels.” You buy these with MANAs, the crypto token for this digital world.

All you need to do is sign up, create a digital wallet, and purchase your virtual land. From then on, you’ll be the permanent owner of that piece of land and can let your imagination run free: Build structures, charge visitors, create art, sell the land, or lease it to others.

This virtual project has about 30,0000 monthly users and market sales exceeding seven figures.

Word of Advice: Observe Legal Considerations

The integration of NFTs in the real estate industry has introduced several legal and regulatory considerations, so before going wild on your capital and spending it all in the virtual world, here are some key aspects to consider regarding the legal aspect of things.

Property rights and ownership

Clarifying the legal status of NFTs representing property ownership is crucial. Jurisdictions may differ in recognizing and treating digital assets, including NFTs. Ensuring that NFTs are legally recognized as proof of ownership and establishing their enforceability in property rights is essential.

Regulatory compliance

Real estate transactions are subject to various regulations, such as property transfer taxes, zoning laws, building codes, and anti-money laundering (AML) regulations. Adhering to these regulations when tokenizing real estate assets and facilitating NFT transactions is important to avoid legal complications.

Cross-border transactions

The global nature of blockchain and NFTs raises jurisdictional and cross-border legal considerations. Understanding the legal implications and requirements when conducting cross-border NFT transactions is important to comply with local regulations, tax laws, and international trade laws.

Smart contracts and legal validity

Smart contracts associated with NFTs must comply with existing contract laws and be legally enforceable. Ensuring that the terms and conditions embedded in smart contracts align with local legal requirements is crucial to establish their legal validity and protect the parties’ rights.

Investor protection

Fractional ownership through NFTs may attract a broader range of investors. It’s essential to implement investor protection measures, such as disclosure requirements, clear communication of risks, and compliance with securities regulations, where applicable, to safeguard the interests of investors.

Privacy and data protection

NFTs and associated transactions may involve the collection and processing of personal information. Adhering to data protection and privacy laws, such as obtaining consent, securing personal data, and ensuring compliance with applicable regulations, is crucial to protect individuals’ privacy rights.

Intellectual property rights

NFTs represent unique digital assets, including artwork, architectural designs, or digital content. Ensuring that the necessary intellectual property rights are obtained or properly licensed is important to avoid infringement issues and protect the interests of creators and owners.

Marketplaces and platforms

NFT marketplaces and platforms should also adhere to legal and regulatory requirements, such as consumer protection laws, anti-fraud measures, and platform governance. Ensuring compliance and transparency within these platforms contributes to maintaining market integrity and user trust.

Moreover, while quite similar, the rules and regulations of marketplaces may differ from one another. As a result, users must obtain a good level of awareness concerning the laws of a specific marketplace before conducting any transactions.

Ready for a Taste? Virtual Real Estate Awaits!

NFTs have emerged as a transformative force in the real estate industry. By leveraging blockchain technology and the unique properties of non-fungible tokens, the world of real estate is becoming more accessible, liquid, transparent, and efficient.

Real estate, too, has been an integral part of the entire NFT world, with properties, assets, fractional ownerships, and other types of real estate NFTs making up a huge portion of all non-fungible tokens. They have the potential to revolutionize traditional real estate practices, reducing barriers to entry and opening up new investment opportunities.

In this article, you learned what NFTs are and how to create NFT real estate. But make sure you do your research before starting any NFT project. Numerous legal considerations must be observed with regard to the ownership of NFTs, especially NFT real estate, and it’s always better to be safe than sorry.

FAQ

Yes, NFTs can be traded on multiple platforms and marketplaces. While some NFTs are exclusive to specific platforms or marketplaces, many can be listed and traded across various platforms.

Smart contracts are self-executing contracts with the terms and conditions directly written into code. They are used in NFTs to automate and enforce various aspects of token ownership, transfers, and royalties. Smart contracts enable the creation of programmable rules that govern the behavior and functionality of NFTs.

The cryptocurrencies commonly accepted for NFT transactions can vary depending on the marketplace and platform. However, some of the widely accepted cryptocurrencies for NFT transactions include Ethereum (ETH), Binance Coin (BNB), Flow (FLOW) which is a blockchain specifically designed for NFTs, Tezos (XTZ), etc. But always research beforehand and ensure you are using a suitable cryptocurrency.